Pastel payroll tax calculator

All Services Backed by Tax Guarantee. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Reporting Season Is Upon Us And There S A Whole Raft Of Forms That Need Filing Soon P11d Forms Should Be Filed Quickbooks Payroll Payroll Payroll Accounting

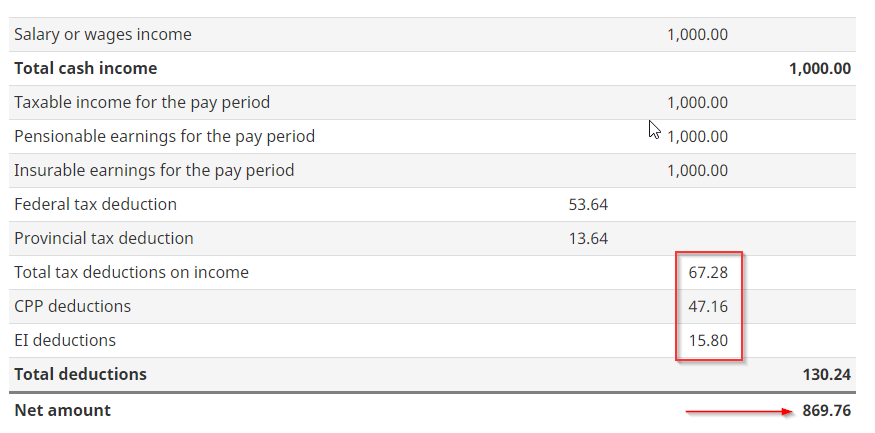

All Fields Required Get Started Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the.

. Determine the right amount to deduct from each employees paycheck. All calculation behave just like the original calculator. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Enter your info to see your take home pay. Get Your Quote Today with SurePayroll. Both you and your employee will be taxed 62 up to 788640 each with the current wage base.

For example if an employee earns 1500 per week the individuals annual. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Payroll Services Pay Methods Employee Self Service Labor Distribution General Ledger Payroll Funding.

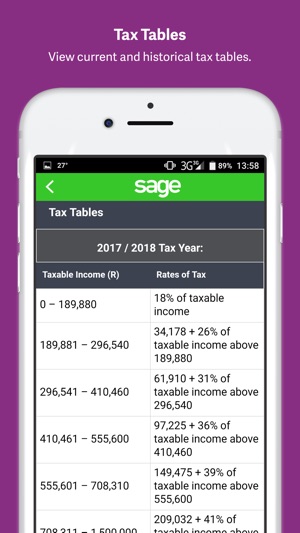

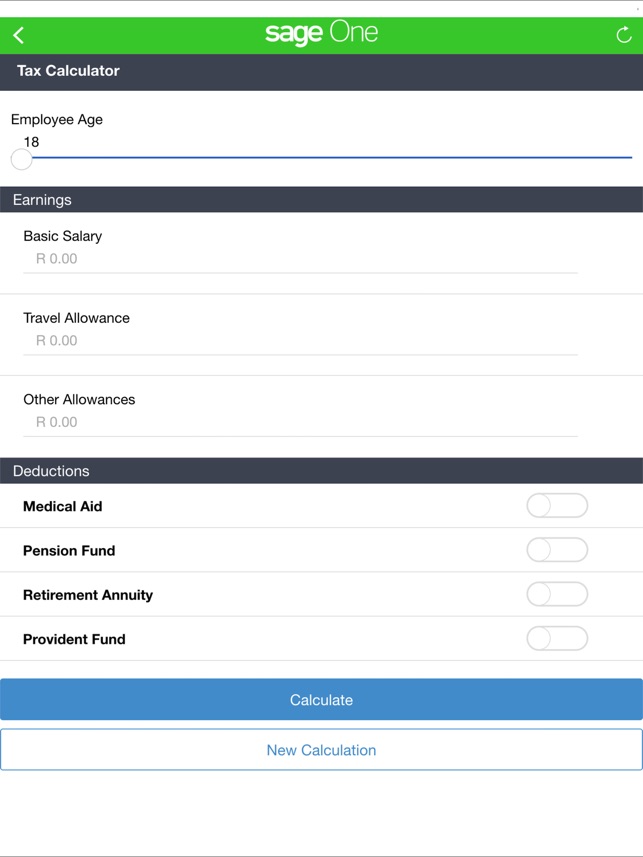

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Medicare 145 of an employees annual salary 1. Sage Pastel Payroll provides a simple payroll and HR solution Sage Pastel Payroll will ensure that you process your payroll accurately and manage your people efficiently.

Double calculator in landscape view. So the tax year 2022 will start from July 01 2021 to June 30 2022. Get Started Today with 2 Months Free.

New York Unemployment Insurance. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Single calculator in portrait view.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. In March and April the employee received R2018076 salary and if you do all the calculations as per SARS tax table I agree with Pastel for the tax of R262786 BUT in May. New York tax year starts from July 01 the year before to June 30 the current year.

Menu burger Close thin Facebook. Plug in the amount of money youd like to take home. Ad Compare This Years Top 5 Free Payroll Software.

Just enter the wages tax withholdings and other information required. Your employees FICA contributions should be deducted from their wages. Free Unbiased Reviews Top Picks.

Employers can use it to calculate net pay and figure out how. Drag Drop No need MR button or copy. Summarize deductions retirement savings required taxes and more.

On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825. Calculating your New York. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Could be decreased due to state unemployment. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Payroll Tax Human Resources TLM Benefits Insurance Industry. Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Enter Payroll Taxes Manually

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Pin On Business Ideas

Best Payroll Management Tips For Small Businesses In Singapore Business Funding Small Business Uk Payroll

Sage Tax Calculator Za On The App Store

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Quarterly Tax Calculator Calculate Estimated Taxes

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Sage Tax Calculator Za On The App Store

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Llc Tax Calculator Definitive Small Business Tax Estimator

5 6 Sales Tax Calculator Template Sales Tax Calculator Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Sage Tax Calculator Za On The App Store

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X